2022 Consumer Trends Index - Global Stats Webinar w/Econsultancy

- 0.5

- 1

- 1.25

- 1.5

- 1.75

- 2

Jim Clark: Welcome to today's webinar. My name is Jim Clark and I run research free consultancy, and I headed up the team, which produced the findings for this brilliant report that we're discussing today. For those that don't know about Econsultancy, we've been creating headline research like this that has guided businesses and validate the decisions since 1999. We only have one housekeeping note, which is for you to ask questions. So please use the Q and A tab and we'll get through as many as we can during the session. Now I'm delighted that we have Cheetah Digital, Tim Glomb, VP of content data. Joining us today for those that are familiar with signals and thinking caps, video podcasts, this is really one marker whose opinion you really don't want to miss. And Tim, rather than me jumping up and speaking about your achievements, secondhand look, do you want to give us the audience a bit more of an introduction to yourself?

Tim Glomb : Sure. I appreciate that, Jim. It's great to be back with you on year three. And in this research report, my name's Tim Glomb as mentioned the VP of content here at Cheetah Digita. I am a 20 year plus brand builder. I happen to jump to the other side of the fence here in the technology world, about five years ago in a B2B capacity, but I've built brands and helped engage and build audiences for the likes of Mark Cuban companies and other global enterprise brands. So happy to be back here today to talk about this. And I have sat where you are sitting, our viewers, you, the marketers I was in your role. So I do have empathy for you. And I hope that comes across as we go through this report. There is one thing I would like to note today. I just have to acknowledge those affected by the situation in Ukraine. We here at Cheetah Digital have people directly affected and I'm some of our viewers have the same. So we do want to acknowledge. We hope that there's a quick resolution, that everyone's being safe. And if you are affected, you are in our thoughts and prayers, but Jim let's get to it. We have some work to do today. Why you set up the impact of this research project and the methodology behind the data?

Jim Clark: Yeah, of course, Tim, I'd love to. Looking forward to hitting your take and yeah, certainly before we get into the weeds, I want to give a bit of background as to why our research with you is so important. And for those who aren't familiar, the study tracks, what consumers expect from the brands they do business with online, the channels they want to connect on. And of course the data they're prepared to share that is to get a more personalized customer experience. And I think what makes this powerful, and I think we were discussing this before this session, Tim was that we're now into our third year. So it provides us with a real window to track changes in consumer trends and sentiments and so forth. And I think at the same time, if you're looking to get a robust global view, this is a place to come to. Now, we serve nearly five and a half thousand consumers, and that's across Australian New Zealand, Japan, France, UK, Germany, Spain. And of course the US. So, a lot of countries involved in that study and the format today is actually in the main focused on my global view across all demographics. And I know Tim will talk a bit further later on about the spinoff reports that look at things by different demographics and regions, but that's our focus today. Now, before a hand over the bold attempt to run through the key findings. And I wanted to set the scene looking from the marketer perspective, since we're looking mainly at consumer findings today, now we just published a report exploring digital trends and retails it's quite timely. And it's based on a global study of 500 client site retail X across similar regions as we've studied for consumer Europe, north America and APAC. And I think that what we found was that after the initial hectic rush into Econs in 2020, 2021 was much more about taking stock and adapting to what has been unfortunately ongoing uncertainty. And as we can see here, the majority of respondents to our surveys or searches in new and existing customers through digital channels, that makes sense to me, not to mention new and changing customer journeys. The main takeout that was from this research was executives don't see things ever going back to pre pandemic state, indeed elsewhere, our survey found that more than half expect the digital experience demands to accelerate in 2022. And now against this scenario, we talked about a number of key things, and I'll just run through this and I don't want to have to run through the entire report with you today. There's enough to cover off. But one of the first key takeouts was that loyalty is under threat. So, of course we've gone digital, there's an explosion of choices. It's harder to be relevant and it requires more work than ever. And of course the driver of this is effective personalization, but there are challenges, especially in retail when it comes to managing consumers concerns about data privacy. And of course the relative value offered by retailers exchange for that valuable ever more valuable first party data. And of course, let's not forget about the demise of third party cookies. The second main takeout was if you're keeping pace, you're falling behind. And now, as I mentioned earlier, experience demand are perceived to be accelerating this year. So having access to first and zero party data is one thing, but also it means be open to new behaviors and the challenges that you're going to have to adapt to as you go through the year. Now, it was troubling that the majority either keeping pace or lagging against customer expectations in that regard. The third point is the struggle to use data. And it's something that sort of, we've been tracking for a number of years and too many brands are struggling to use the data they have on customers. And this is true when it comes to first party data in particular to drive personalization, indeed only 23% of executives felt they were highly effective using it to personalize the customer experience. Now, a lot of what we came out from the research ties with what Tim will be discussing today in particular, how to effectively use digital channels and loyalty programs to build trust and that in turn knocks, rich data sets and all the good stuff. Anyway, Tim, over to you I'm looking forward to hearing your perspective.

Tim Glomb : Jim, thanks for that. You guys always have great insight in that report. You just kind of mentioned, there's a lot of that mirrored here on the consumer side as well. So I'm excited to get into it. But first as a reminder friend, anyone watching today, you're going to get access to this full report, including an appendix of all data so that you can dig deeper on country, age, and other factors that suit your needs. We'll also be creating several other versions of this report along with many supporting webinars that will drill into things like age perspective, the differences between say Gen Z and Boomers, as well as industry points of view on the data and trends you're about to hear. So be sure to watch out for email invites from Cheetah Digital, hitting your inbox soon, but I'll start with a few bullets from our executive summary featured at the top of the report. This includes the idea that consumers no longer give a damn about your marketing plan quite frankly, and they're no longer take the path that you've laid out for them when they're engaging with your brand. Consumers control their own journey from discovery through to loyal customer and marketers need to be more agile than ever in supporting that landscape. As Jim just mentioned, though, marketers are still struggling with the ability to personalize experiences for customers. Even though there is a deluge of data available to them, we have entered the age of what I'll call consumer empowerment and the brands that are winning have invested into the people and the technology to enhance and evolve the customer journey, wherever Jane or John Doe decide to go, whatever their path looks like that brings us to another realization in today's world. Recognizing consumers as individuals is paramount, long gone are the days of mass segments and inferring intent based data and outdated data. Sometimes just outright bad data. Brands must be listening to the individual and their unique signals across all channels to support that personalized journey. Furthermore, privacy is a front seat issue as you guide consumers closer to your brand. Balancing protection permission, all kinds of related customer data issues is critical to getting it right with your audience. Lastly, as Jim mentioned, loyalty is still a key driver when it comes to the customer lifetime value, we'll share some data that shows what consumers expect from your brand and the reasons they will abandon you. Deciding to not make retention and advocacy a focus for your customer base will hurt your bottom line, guaranteed. And Jim, as you know, the reasoning behind these thoughts are available in our executive summary at the top of the downloadable report. So all of our viewers should read that section when they get it.

Jim Clark: Yeah. Thank you, Tim for that, I guess we should move to the key findings now dig into the data.

Tim Glomb : There are at least five main takeaways that we identified as growing trends from the three years of research we've done with you. If you left the webinar right now, these would be the five things you need to remember and consider as you build customer engagement strategies. So I'll go down them very quickly. Number one, when it comes to driving sales, email has always been one of the most effective channels, especially considering its ability for hyperpersonalization of content and offers. And in fact, email still beats banner ads, social media ads, organic social posts and SMS by up to 108% with half of the consumers reporting that they've purchased a product directly as a result of an email they received in the last 12 months. So email's still king. Number two consumer are loyal by nature, but what they expect from the loyalty programs that turn them from one off consumers into loyal brand advocates is maturing. We've seen a stark rise in consumers expecting contests, sweepstakes that had a 73% increase, exclusive access and content. That's a 58% increase year over year, personalized product recommendations saw 56% increase and then brand recognition just mentioning people. And the actions that they're taking with their brand saw a 45% increase year over year. So as ever brand loyalty is on the rise with 57% of consumers prepared to pay more to purchase from a preferred brand. Now this is backed up by huge increases in the number of consumers who are loyal to a brand because they understand them as an individual. That's a whopping 110% lift year over year. We'll talk about that a little later. Their other factors are they're loyal because the brand reacts and treats their data with respect and they're loyal because the brand aligns with their personal values that saw a 53% increase right there. The fourth key takeaway is that the majority of consumers want to receive personalized content and offers from trusted brand and will readily share personal data for them. However, they prefer brands that use data that's been explicitly shared directly to the brand. Now this is the definition of zero party data and they don't feel comfortable with cookie fueled ads or location tracking. They will see this as a creepy marketing tactic. So we'll dig into that as well, a little later, and the fifth takeaway that we found from this, Jim, as privacy regulations sweep the globe and data breaches continue to dominate news cycles, consumers are more privacy conscious than ever online. We have seen huge rises in those turning to incognito browsing 50% increase year over year, a PC cleaner, a password generator, ad blocking technology and/ or paying for premium software or using a password manager, which 31% increase right there. And I'm one of them. So Jim, definitely big five key takeaways that you have to take away from this report.

Jim Clark: Great point, sir. Tim, look, let's dig into the actual questions and answers and explore some of those trends across the many areas that this report covers.

Tim Glomb : Absolutely. In fact, we are about to go through the entire report. So when you download it, this webinar can be that second screen experience. So to say, so let's just dig in and I'm going to move pretty quickly. First off, as the previous two years of research confirmed, email is still a main driver of revenue with consumers, both online and for traffic in store. We see here that based on consumer responses, email app performs SMS by over 108% when driving revenue and that's a 9% lift over 2021 stats, further, email outperforms banner ads for driving sales by 53% that saw 6% lift. Lastly, email outperforms organic and social posts and social ads by over 19%. So our main advice to anyone not invested heavily in email right now is do so and do it today. Email is a channel that has a long history of engagement, and it's one of the easiest channels to personalize offers of messaging using both zero and first party data. It really does drive significant engagement when you go that extra mile, Jim.

Jim Clark: That's really fascinating, Tim. Now, what are the major concerns, especially with Apple's recent iOS changes, are they creating false positives for open rates on email say being sent to Apple mail?

Tim Glomb : Yeah, good point. And we get that question all the time. And here at Cheetah, like every other service provider, email service provider, like us, those open rates, they decline with users on Apple mail. We just can't deny that, but what's really happened since that roll out of iOS 14.5, I believe it was, was a shift to get serious about personalization, the brands that are doing it well, have really focused on that. When you're using customer data to personalize the subject line well beyond just using their first name, injecting that in, it has tremendous impact on engagement rates. Some of our clients Cheetah Digital are seeing lists of over 70% when adding personalization in the subject line and inside the content of that email, that engagement is rising as well. So shifting to an engagement strategy beyond just an open and click strategy is critical with Apple mail and other pending privacy or other platform changes that might come. So as more brands adopt the technology to deliver personalization, we'll see this channel of email continue to outshine some of the others, especially as ad targeting, starts to disintegrate with the deprecation of cookies, et cetera. So, Jim, my advice has always been and always will be build a database, elevate your email capabilities.

Jim Clark: Wow. So you've sent at strong numbers there in great context. What's next on the list?

Tim Glomb : So let's move along. And when we're looking at other things that impact the buying decision price, still reigns as champ for the third year in row, that's probably, that's not a big surprise, lower prices impact buying all the time. It always has, but we did see a 14% increase in consumers hunting for the best price compared to last year. So consider that they are moving to more price conscious mode. This year, we saw 41% of consumers noting that they will try to get the best price possible. So it's all about value for their spend these days. And it's a growing desire actually. But another factor they chose as influencing buying decisions was wanting brands to behave responsibly. And that was interesting to me, 16% claim, this was a motivator for purchase and they've decided that they will vote with their wallets here, Jim.

Jim Clark: Well, that's God not surprising with rampant inflation that's going on right now. And I'm certainly looking at the costs that are out there and trying to minimize that. Moving on. How about trends across mobile devices? What are we seeing in that area?

Tim Glomb : One thing that's been constant over the three years is that mobile is continuing to grow as a channel for shopping, not just direct e- commerce and clickable inside mobile, but mobile as a channel to inform and persuade purchase. This may not be a surprise, but here are some of the data that we gathered from the report. 52% of consumers have purchased a product or service in a mobile app. That's an eCommerce action on an actual mobile app, but also 52% of consumers have used a mobile phone while inside a physical store to research or help make a decision to buy in the store. That's a pretty big number in my opinion, 52%. Of the same respondents, 47% said that they have browse products in a physical store, but then made the purchase online. So it goes both way there, mobile has a huge impact on purchase decisioning as well as the actual transaction itself. Now keep in mind that consumers interact with an average of six digital touch points when engaging with a brand, whether that's via social media, payment through a digital wallet, maybe offers from SMS or email, et cetera. But all of those touch points can be directly accessed by consumers through a mobile device. That means mobile is no longer a nice to have. It's a must have. Now we did see a 19% increase in consumers who have bought something because of an email that they viewed on their mobile phone. So we know email is a driver, but 37% have bought because of an email on their mobile phone. That's a lot, the only stat that was trending downward when it come to mobile was content. So media publishers and those in the content business, this is a stat for you to dig into. There was a 13% decrease in consumers who have bought digital content via a mobile phone with only 35% to do so. Now we define content as a paid app or something like a music video or even like a movie download. So mobile's still on the rise overall, Jim.

Jim Clark: Yeah, indeed. It's a critical channel for marketers. Now how about the factors driving stronger relationships with consumers? What are the trends that consumers expect from their favorite brands?

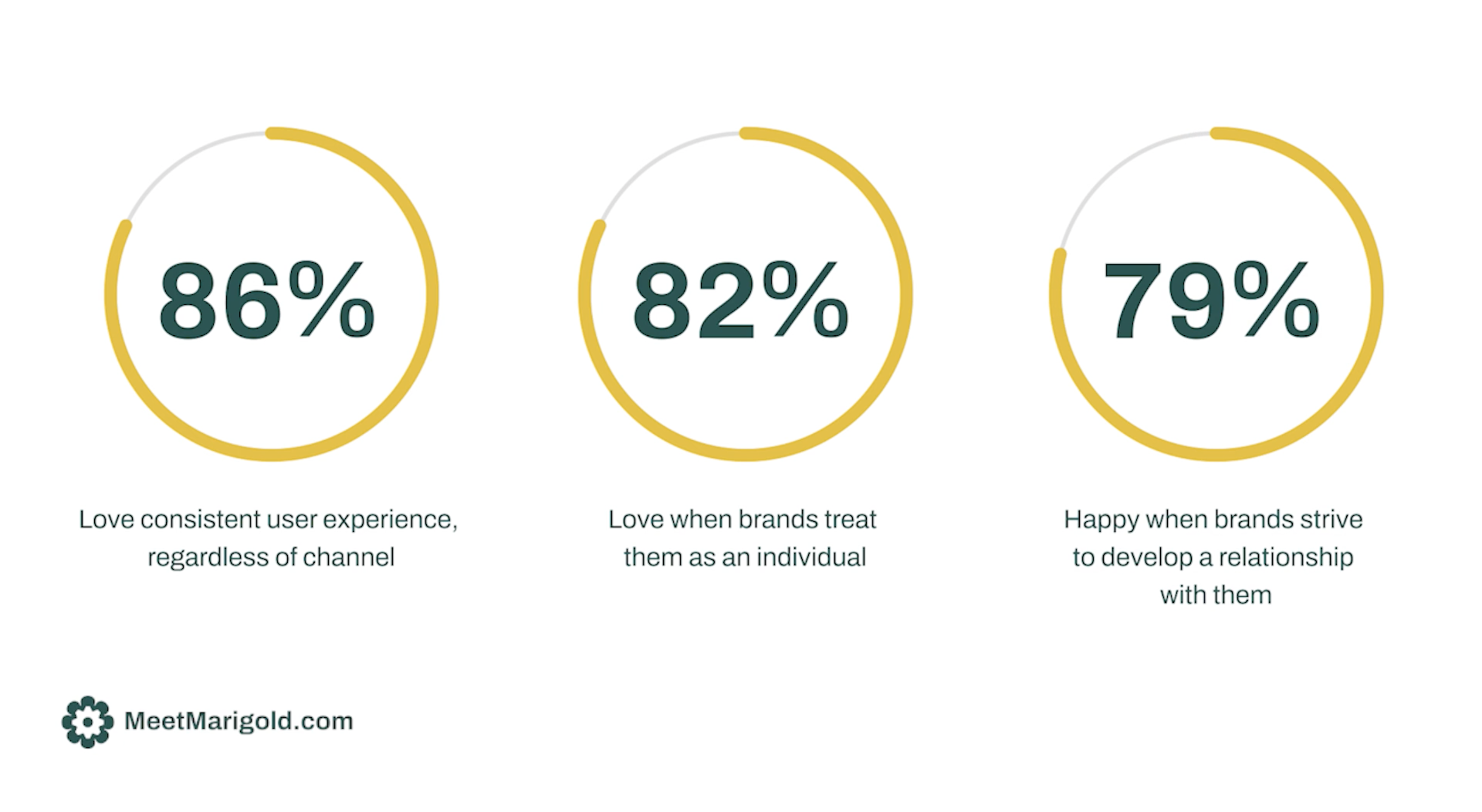

Tim Glomb : Yeah. Well, definitely look here at Cheetah Digital. We are in the relationship marketing business fair and square. I mean, we love to own the phrase of relationship marketing. So I'm super in tune with these trends and super interested in the data that you gave us back about their favorite brands. We asked the audience, what were some of the experiences they loved when thinking about their favorite brands in particular, here's some of the stats, first off, 80% of consumers have a favorite brand as it provides a consistent customer experience. We talked about listening and engaging in channels across all channels. So this is a big driver for brands who are getting it right. By the way, this was also the number one attribute last year when discussing how brands are winning the label of favorite. So second point here, 78% of consumers have a favorite brand as it rewards them for their loyalty. This is a 3% uptick from last year and a very close number two against that consistent experience we just mentioned, but acknowledgement of a customer's actions beyond just purchases is critical here. And we'll dig into that deeper in the loyalty section. Third, 74% of consumers have a favorite brand as it uses their data in a way that makes them feel comfortable. So transparency with data is obviously important. 74% also said that they have a favorite brand as it treats them like an individual haha. There is that personalization buzzword again, although it's not a buzzword, this is a fact. 71% of consumers have a favorite brand as they feel it strives to develop a relationship with them. So listening is a major factor in that you can't have a relationship by just talking at them. You have to be listening just like your relationships with other humans in your life. Now 64% of consumers said that they have a favorite brand as it surprises me with rewards I don't expect surprise and delight. There you go. Always a crowd pleaser. And lastly, 58 of consumers have a favorite brand as it treats them like a VIP, so recognition for their loyalty is also an important factor there, Jim.

Jim Clark: Well, it's nice to know what you need to do if you want to be someone's favorite brand. Personally, I'd love to be treated like a VIP and generally speaking, a lot of what you mentioned should certainly be every marketer's goal. How about the way that those favorite brands communicate, Tim? You know, what did we learn from the results there?

Tim Glomb : Yeah. Jim, good point. There are definitely trends there to consider, your communication frequency should always be based on your typical customer's purchase cycle and data in their profile. If customers typically make a repeat purchase every six months, don't inundate them with targeted emails or, retargeted ads right after they've made a purchase. It just doesn't make sense. More than half of consumers, 51% to be specific, describe the relationship with their favorite brand as they communicate as, and when necessary. Now that a sweet spot. And you really only learn that through progressively getting to know your customer. Now, 23% of consumers describe the relationship with their favorite brand as one that understands them. So when I say progressively, get to know your customer, I mean, both transactional and behavioral data over time, but let me also be clear. You should also be progressively profiling them. That means proactively reaching out and asking them questions, even in between transactions, the things you need to know how to communicate, how they like. If I knew Jim, you were a vegetarian, I probably would not invite you over for a state dinner. Well, brands can't always deduce or infer an individual's budget for their products or even when they may, buy again or which channel they want to buy in. They just can't infer that. So go direct to the source and ask them. You'd probably be surprised just how many of them will give you psychographic information, just because you asked for it. But value exchange will sweeten that pot. We are masters here at Cheetah Digital, the value exchange. We have tons of examples of clients doing this really, really well. So I encourage you to check that on our website and we're actually going to cover value exchange as a section in a little bit here, Jim.

Jim Clark: Good to know. And just so you know, medium rare every time. So that's inaudible now you talked, obviously you talked about personalization and how it's delivering increased engagement for a lot of your clients. What did our audience share in this particular section in the research?

Tim Glomb : It's pretty clear. Consumers are frustrated with the lack of personalized message they're receiving with 49% of them feeling irked by irrelevant content or offers from brands. And the story for me is that's actually a 17% increase from last year. Now, 41% said receiving messages that don't reflect their wants and needs was annoying. An example of annoying one might be inferring that the one item they purchased from you is reflective of what they actually want from you over the long term, when really, maybe it was a birthday gift for someone else or their wife or what it might be. The real stat here is that saw a 52% increase from last year. So, give pause right now and ask yourself is your brand a culprit? The trend is very significant. And one you cannot ignore. You need to know your customers better than a single transaction and the practice of inferring or trying to deduce what your customers want can really be a customer turnoff. Now carry on nearly a third or 31% to be exact, do not feel a brand has even recognized their shopping or loyalty history. Furthermore, 35% of consumers felt frustration when they received messaging based on what seemed to be information about them that had not been directly shared with that brand. Now, personalization is the core to any relationship marketing. This means is about delivering value, relevancy, and creating meaningful experiences to individuals based on their own preferences and that explicitly shared data, not third party or inferred data that may have been bought, sold or collected by tracking snooping. So the strong recommendation here is that your personalization and messaging strategy needs to be rooted in both first and zero party. And I would add that you need to strive to be collecting psychographic data. That's declared directly from your consumer base, creating messaging opportunities based on transactional data. You know, that's good, but using zero and first party psychographic data to personalize those messages will differentiate your brand from your competitors. And remember, this is your audience saying this, not just me. I mean, Jim, I preach this, but the data doesn't lie.

Jim Clark: Yeah. I mean, good points there, Tim. And going back to the beginning where I was talking about the value of doing research year after year, it's amazing to see that 52% lift that is significant and slightly worrying. Thanks for pointing that out. Now, how about the amount of messaging brands are sending consumers? How are they working out there?

Tim Glomb : Let's take a look here. Whether it's through email apps, social media or SMS, consumers are generally pretty content with the volume of messages they're receiving from brands. So that's good news. Now, when it comes to answers on volume of messaging and answers like it's about right, or we would like to receive more messaging, the numbers are pretty positive. We asked a few scenarios and hear the stats from consumers that said they feel they're getting either the perfect amount or would be readily willing to receive more messages on the following topics. 71 said discounts, 65 said messages about their brand value. 71% said messages about their loyalty program. 68% were happy or wanted more VIP offers. 73% said more treats, 72% noted free delivery offers. And 55% said they get the perfect amount or would take more messages related to ongoing sales. But conversely, let's look at some other ones. When it comes to feeling overwhelmed by messaging, meaning they're getting too many, the numbers are not so bad actually. 11% said they get too many messages related to discount. I don't think that's too bad. Only 12% said brand value messages are overwhelming. 11% said too much info on loyalty programs. 12% said too many VIP offers. Well, sorry, Jim. I know you want to be a VIP but, only 10% said too many treats. 10% also said too many free delivery offers and 16% noted too many sales messages. So in all those brands that are winning with messaging across multiple channels really do master that craft the art of connecting with their customer on the right channel with the right message. And at the right time, these are the brands that are having both listening and engagement strategies that are really, really working in tandem, Jim. So another important factor to consider in your relationship marketing strategy.

Jim Clark: I love the way you pulled apart the stance there and broken them out. So, and certainly something every marketer needs to consider when looking at the kind of messages that send out and not to mention the cadence of them. Now, should we move into the loyalty section now I know you itching to me start as well. I know this is a real sweet spot for Cheetah Digital, and I'm sure you are pretty excited to share the results.

Tim Glomb : Oh, absolutely. Loyalty is huge for us here at Cheetah Digital. It's a core offering in our engagement platform, much like messaging as well. I mean, we've won a ton of awards in recent years with loyalty. So there's plenty to be learned here from the audience. So let's dig right out. Now, first we asked the audience to think about the brands that they bought from and their personal loyalties in the previous six months. And would these following statements be true? Well, 57% of consumers are prepared to pay more from a trusted brand, but that's actually a decrease of 11% from last year. So conflicting numbers, right there, that's sort of alarming and many markers that might be a sign that your brand needs to build stronger relationships, to keep those customers and justify the higher cost associated with your products or services. Now, 78% of consumers say that they are loyal to a particular brand, but will look elsewhere if it's cheaper or more convenient. Now this was only a 4% decrease from last year, which means less people are leaving brands solely on price and convenience. That's actually a positive thing for brand marketers. 67% of consumers say there are examples where they frequently buy from the same company, but they don't feel loyal to that company. Now this was a 9% decrease year over year of the same question, showing that loyalty is growing with consumers buying the same brands over and over and only 29% of consumers are not loyal to any particular company. Now, loyalty programs used to be reserved for airlines and grocery chains. Let's just admit that, but today they are in every vertical and go way beyond points for purchase.

Jim Clark: Yeah, I mean, it's increasing complex to get a beat on what drives loyalty, particularly from what you were saying about emotional loyalty. So it's great that this research has split that out and I'm sure you can have people downloading this report immediately after the session. How about the flip side? What do consumers frustrate with in the loyalty space?

Tim Glomb : Sure. Can't talk about the good without the band, right? There's certainly a cost when you get loyalty wrong. I will say that. Now emotional and genuine loyalty is actually an outcome. It's a goal you can only achieve by truly knowing your customers and carefully nurturing every single relationship that you have. That means every action, the input, the communication, everything a customer receives should make them feel valued and respected. Now, many brands are still investing far more resources in a customer acquisition strategy rather than a customer retention strategy. So rather than a crew new customers in the imediacy, there definitely should be a focus on maintaining relationships with your current customer base, with trust becoming as much of a differentiator as price and product. So here are some of the stats to consider. Now almost a third of consumers, 31% actually have switched away from a brand they previously liked to buy from. So what were the reasons? Many cited a competitor of having better promotions at 31% or buying options said 26% because they didn't feel valued as a customer was 21% and 19% of those who switch brands said it was because a brand stance on social, political or environmental issues were the cause. But fear not loyalty is on the rise. And the vast majority of consumers are willing to increase their participation in loyalty programs. In fact, Jim, 40% of consumers are more likely to take part in a loyalty program than last year. And that is an 11% increase from those that said the same thing from 2020 going into 2021 better yet only 8% of consumers are less likely to participate in a loyalty program than last year. That is a staggering 38% decrease from the same question post in 2021. So obviously loyalty is strong. It's a driver and less people are falling out of programs. More people are getting into, Jim.

Jim Clark: Tim, that makes a lot of sense to me actually, given that loyalty programs are often a gateway to getting value and discounts. And we cover that often in an earlier slide. So clearly it's a positive trend for brands that are adopting and offering loyalty solutions. But what other trends round out are digital loyalty, particularly when it comes to attitudes that consumers have?

Tim Glomb : Yeah, sure. There's a point I need to drive home here first. And that's that a loyalty program is not necessarily a rewards program. I think a lot of brand think they need a points for rewards program or a points based program simply because they equate the term loyalty program with rewards program. Things like points from purchase or points to win prizes is merely one of the different tactics you can use to help engender loyalty. Also the heart of loyalty is not merely the cheapest price point, but a brand that can actually foster community, one that recognizes the customer as an individual and delivers content and product recommendations. That's a brand that will foster loyalty and ultimately lead to brand advocacy. So first, let's look at some of the expected or well known factors that drive loyalty. 59% of consumers are loyal for basic points of rewards. Now I got it and we all know those programs and what they look like, but 64% of consumers are loyal for discounts on their products and services. 30% of consumers are loyal for exclusive and early access to product services, events, content, et cetera. 25% of consumers are loyal for suggested product services based on their preferences. 20% of consumers are loyal for communicating with them in the channels they prefer with examples being email, SMS apps or on their website, but what's worth noting here are some of the other factors that can be used to engender loyalty beyond the points for purchase or basic reward schemes. There was a 73% increase year over year in consumers who are loyal for contest and sweepstakes with 19% noting that, that was a driver of their loyalty. I love that. There was also a 45% increase in consumers who are loyal simply for recognition from the brand with 16% stating that as a fact, and we saw a 33% increase in consumers who are loyal for community and statements such as I want to connect with other people who like the brand. Now 12% claim that this was a driver for their loyalty there Jim. So clearly a lot of different factors you can use to engender loyalty.

Jim Clark: Yeah, I was going to say, it's interesting to get a wide look at the different factors you've counted for in the research. And it's also interesting to see these, the findings year on year in terms of trends around loyalty. It's definitely a lot from up just look at, in this section. So look, where do we go from here?

Tim Glomb : Next. We asked bunch of questions regarding consumer data. What were people willing to share with brands? How they feel about cookies and tracking as well as what drives them to share data. First, we'll look at the creepy marketing tactics related to cookies and snooping on consumers. The overwhelming majority of consumers still feel that advertisements drive from location data, third party, cookie tracking, and smart devices. Listening to them are creepy and they are not cool. They are however split on the use of chat bots, accessing purchase history and ads on social media based on recent shopping experiences. So let's dig into them when asked if these were creepy and not cool the following percentage agreed. 67% of consumers referenced ads based on location data creepy, 62% of consumers say ads derive from cookie tracking are creepy, not cool. 61% of consumers say ads related to something they talked about near a smart device also creepy. I totally agree. So let's flip it and let's talk about some of the things consumers actually liked. 80% of consumers say recommendations based on past purchase history is cool. That's a 10% increase year over year. So that tactic is definitely working. 65% of consumers say an email reminder about an abandoned cart item is cool and that's a 20% increase from year over year. So get those abandoned cart journeys set up. 51% of consumers say a chat bot with access to purchase history is cool. And that's a 16% lift since last year. And lastly, 61% of consumers say personalized offers after they've been on a brand's website for two minutes. That is cool. So behavior on your website and then following up with that offer, that is a pretty good one. So Jim, we covered both the creep factor and the cool factor.

Jim Clark: No, I always love the creepy cool factors in the research each year. So it's great to listen to those. And I hardly agree with ad space on devices, listening to you that freaks me out more than anything else. Now, what are people looking for in exchange for their data? Are there any new trends out there you can sign post?

Tim Glomb : Yeah. Well, the first and foremost, the value exchange economy is alive and well. And my co- host at thinky caps podcast, Richard Jones. He was on the webinar last year. He has been a huge promoter of this concept and was a super early trend setter. Proving it out with some of the biggest brands on the planet. So Cheetah Digital has a ton around value exchange economy. If you want to dig into what that is and some examples, the idea for value exchange economy is that if you want your customer's preference data, you need to offer something tangible in return. That is, that's the definition of value exchange. It is possible for retail marketers to collect this golden data, but it's not the case of simply asking you shall receive, more than ever modern consumers expect to be entertained. They will want to be engaged. They want to receive something in return for their attention and certainly something in return for their personal data, but it doesn't always have to be a huge prize or even just a huge discount. Sure. 93% of consumers are prepared to trade data for a discount and 92% will trade for loyalty points. Additionally, 84% will spill the beans for a chance to win a prize. But consumers are actually sharing behavioral and psychographic data for things like exclusive access with 86% saying so. 61% said they would take unlocked content and 55% simply want to feel that they are part of a brand's community. We mentioned that in the loyalty section as well, but there are many more carrots that a brand can dangle. Let's look at a few of the tactics marketers can use to acquire personal data directly from consumers. That's zero party data. These were selected as the highest value offerings you could make to your audience. 59% of consumers find discounts or coupons highly valuable, and that it's 11% increase year over year. 54% of consumers find loyalty points of rewards highly valuable as mentioned, that's a 17% increase. 39% of consumers find the simple chance to win a prize highly valuable, that's an 18% lift in the stat. Other options that were selected as simply valuable to our audience included 93% of consumers wanted discounts and coupons. 92% loyalty points and rewards as mentioned, 84% find the chance to win a prize as simply valuable. So that's different from highly valuable, as we mentioned earlier, and then lastly, 80% of consumers find early access or access to content as valuable. So what we did there is break down highly valuable and simply valuable, but those numbers are so high in all of them that clearly the value exchange economy is alive and well. And you got to get that zero and first party data to personalize your offering and messages. So take these stats to heart and bake them into your marketing strategies. That's my advice, Jim.

Jim Clark: That's certainly a lot of carrots there, Tim, and it's good that the research is sanity. Check that and moving on. What about the issue of privacy? Of course it's been a hot button issue the past year or so. How are consumers feeling about this topic this year?

Tim Glomb : Yeah. Jim, look, this is not only, still a major topic on everyone's minds, but concerns are growing with consumers and they're actually taking more steps to protect their own data as well. We recently hosted an exclusive webinar with Christopher Wiley, who was the Cambridge analytical whistle blower. He blew the lid off the Facebook misuse of customer data here in the US around elections, et cetera. It was one of our most attended webinars ever because it was anchored in his experience and knowledge of how consumer data is being used behind closed doors, specifically in nefarious ways and the interactive polls during that session, I got to say they mirror a lot of the data in this report that we're about to share. And by the way, you could watch that on demand session @ cheetahdigital. com. But for the purposes today, let's look at the trends from the research. We're a good few years after that at Cambridge Analytical standalone I mentioned, but many of us as marketers have become headline blind to the constant stories of privacy breaches day, the gathering by big tech and urging privacy legislation. That's impending or already being laid out, but consumers are not blind to it. In fact, they're ever more cognizant of the value of their data and they're taking proactive steps to protect it. Now more than half of consumers are using a PC cleaner with 56% stating so, and well over 38% have turned to ad blocking technology. 37% are using password managers. Another startling fact is that 50% of the poll consumers are personally using an incognito browser. That is a massive number, 40% are using a password generator beyond the actual password manager and 32% have moved to paid for premium software that protects their privacy. So the solution is not to find ways to circumvent this trend, but commit the forging, honest, meaningful relationships and adopting a full fledged privacy first strategy that's anchored in transparency. But let's take a look at the cookie data because, how can you not look at cookie data? The story of the cookie. I'm not going to re- explain it here at this point, everybody knows about it. Third party cookies tracking your behavior from website to website and digital property to property are going away in 2023. So says Google, most markers are living in fear of that date, but there's some interesting data from this report here that they should dig into. First of, it was surprising to me that only 13% of consumers will miss cookies and think that they made for a better online experience. I'll just note, I'm probably one of those people. I mean, I don't know about you, Jim, but I love not getting ads for minivans or feminine products I don't need. So maybe Google needs a look at that stat. I don't know alarmingly though 37% of consumers are optimistic brands will come up with a way of sharing data. That is fair for everyone. And I am just going to outright laugh at that one because consumers just don't understand that every single marketer, every single marketer I've spoken to, they are like so afraid of this. They have no clue what's going to happen. They don't know how to implement it. They don't build technology. So I think many agree that the platforms and legislators that are worried about privacy right now are also perplexed. So I guess time will tell story there, but consumers, they're optimistic if brands are going to get it right. So it's on you brands, I guess. The last stat on that one 31% of consumers are glad cookies are being withdrawn. So there is some awareness there. Now those are stats on the consumer's POV around cookies and I'm sure most marketers wish their sentiment could help stave off the cookies death in some way but just because consumers want cookies to persist, they're probably not going to. So I guess the story from those stats is that brands need to figure out how to explain to people who enjoy targeted ads and experiences based on these third party cookies, why their brand can no longer deliver them after the demise of cookies in 2023. That's going to be a conundrum for brands, Jim.

Jim Clark: Well, is indeed. I mean, it's fascinating. We're talking about cookies all the time with marketers. So it's unique to get that to consumer perspective. And it's also interesting to see the consumers seem fairly unaware of the reason for cookies demise. And it will be interesting when they do finally disappear if they do in fact disappear. Now that, and how about the topic of brand trust with consumers? How is the data trending year over year in that department?

Tim Glomb : This is the second to last section that we have here. And there is actually good news in that department. Trust is on the rise pretty much across the board when looking at industries or verticals, the report has a great chart, which I'll show here. So you can get a peak, get your own industry, but I'm not going to bore everyone with the stats, unrelated to their industry, but definitely download the report to see more, including the full appendix of raw data to see how is your industry doing across, not only trust, but all the other data points we've shown so far, but there is some strong advice. We have been hammering marketers when looking at trust data over the past three years, and it's backed up by many of the trends we're already discussing today. If you don't own a direct connection to your audience, you're going to suffer and I'll share a few key stats in the trust section that's coming up, that you should wake up to that really hammer home this point. First, we asked when it comes to social media platforms and the security of your personal information, which are following statements best describes your attitude? And here were some of the results. 58% of consumers say they do not trust social media platforms with their data. Now, how many of your experiences with consumers are rooted in social channels versus a channel like email or SMS where there's no algorithm or censorship affecting the delivery of your message? How could you answer that question? Plus you pay for reach on social media platforms that unlike email or SMS, where you just have a platform and you send, and historically brands are constantly getting wrapped up in the missteps of these social platforms and they bear the brunt of consumer angst when things like a stop hate for profit movement pop up. So, think about that from your brand. I believe it was also P and G that after the stop hate for profit, they claimed that when they removed their massive spends from the likes of Facebook, they really saw no major impact on their sales. So think about that for all those reasons plus obviously many others. You need to invest in direct communication channels, where you can personalize messages at scale personalize those offers and protect your brand well get where upwards of a 99% delivery rate across email and SMS Jim. So that's my advice there in the trust section.

Jim Clark: Oh Tim, not 50% stat in the examples you gave paint a pretty compelling argument, but I guess that brands have to decide where where they want to invest, right? And how about e- commerce? What did this report tell us about revenue and e- commerce trends this year?

Tim Glomb : Yeah, actually there's two slides I want to share as we draw to a close today, and this is the last section, but also I need to employ you to download this report, draw on your own conclusions for your own industry, your own needs, et cetera, the Econsultancy team here. They did a great, amazing job pulling these insights together, including my team here at Cheetah Digital. I mean, they curated a wonderful report when you see it. So I got to shout out to Jen and Katie and Danny a and a few others there. So let's look at the e- commerce slides here. And the first slide I want to show you is the increase in consumer adoption of e- commerce across industries. I'll refrain from reading all of them here, just look for your industry and you can see all of them in the report, but we see some significant increases in e- com adoption across the board. This is great, as we hope and expect to see more brick and mortar action in the return to 2022. But remember consumers are using their mobile phones more and even in store. So do not expect e- com to drop or even slow pre pandemic trends are arguably in the history books as you noted in your opening statement, Jim, we've done a great job getting brands to escalate their digital transformation efforts and consumers followed suit, but more mobile, more e- com and more channel transactions. Like that's what you can absolutely bet on. The second slide here is the last slide for today, and it's focused on the increased sophistication of the customer experience across industries. We ask consumers of those companies you've purchased from in the last six months, which do you think provided the best online customer experience. Now these are year over year numbers. The report has the actual baselines, but you can see clearly there's a lift across the board, another testament to the brands, making the effort to enhance that customer experience, joining channels, et cetera. So hopefully your brand is sitting more towards the right side of this where there's higher levels, but no matter where you fall, your industry is making strides. So a kudos to you and your industry. You're seeing a lift in that customer experience. So Jim, that's all I have for today, but I'm already working on more perspectives on this great data set that you've created for us, including a US only version that's going to happen here later in March. And also a version looking through the lens of the four age brackets. That is a very compelling story to be told from the Gen Z all the way through Boomers and how they react across these topics. So I expect all of those things to roll it out on cheetahdigital. com over the course of the next couple of months. So please look for your emails from Cheetah Digital and your invites to even more points of view on this great survey that Econsultancy has built for us.

Jim Clark: Woo Tim, thanks here, downloaded the results today. You're going to need a lot of water after that. Some great stats and I think really a powerful motivator to download the report. The fact that you've got such a beautifully designed report and all the data to dig into in the appendix is going to be very useful for the audience today is they certainly, as they look to digitally transform in 2022. And it's also great to see that, taking a step back, the brands have finally got the message that they need to move from interruption and persuasion to delivering value and critically information in real time. And of course the big call out for me was the virtual cycle of loyalty programs and the role they play, not only serving as a foundation for collecting ever more valuable customer data, but also in retaining loyal customers. So, clearly keeping pace with customers isn't enough in 2022 brands need that first and zero party data and only then can they really engineer that experience that demonstrates empathy and understanding that you talked about earlier in the session. Anyway, I know we've pushed for time. You've gone through so many wonderful stats and insights on that note. I just want to thank you. And also the audience and really looking forward to seeing more of the same going through the next couple of months. So thanks very much, Tim.

Tim Glomb : Yeah, Jim, I appreciate it. And I can't wait to do it again for 2023.

DESCRIPTION

The 2022 Consumer Trends Index Webinar from Cheetah Digital, in conjunction with Econsultancy, reveals key trends from consumers over 6 countries related to email, sms, loyalty, privacy and personalization among other commerce related topics. This webinar dives into the key stats and what marketers need to know to build better relationships with consumers and increase customer lifetime value.

Today's Guests

Tim Glomb