Why the financial services industry must personalize across all customer touchpoints

- 0.5

- 1

- 1.25

- 1.5

- 1.75

- 2

JULIAN: Hello, and welcome to the first of Signals 20 industry panels, where we will be talking to clients and partners who are experts in their field. Hang on a second, Kayla. Do you know what I'm worried about?

Kayla: What's that?

JULIAN: What the audience is thinking and no, not about whether I'm wearing anything below this row fetching shirt and tie.

Kayla: I was actually worried about that too, but also, it just might be the low- budget production we were forced into after Tim and Rich decided to spend all of our money jumping out of that plane. inaudible

JULIAN: Not a marketing show ponies. Excellent point though, Kayla. What I'm worried about is audience Zoom fatigue. Can the good people at best sit through more talking heads, even if the heads are as good looking as ours, and as full of knowledge like our guests?

Kayla: Yes, that's a good point.

JULIAN: Let's have the very talented folks and our Chia Studio team take care of all of the above. Let's see if they can do anything to improve our surroundings and make these sessions more animated. Guys, what have you got?

Kayla: Oh, man, they took you literally, maybe they ended up finding some budget after all.

JULIAN: This is blooming marvelous. Look at my tie, it got spots, cheery. There's my bike. Somebody's been watering the plants, and Kayla, look at you.

Kayla: Oh man, look at this. It's nice to be back in the office again, actually.

JULIAN: Now that's sorted, let's reveal the topic of our first discussion.

Kayla: All right. So today we're going to be joined by some fantastic and equally animated experts in the financial services industry, to talk about why financial services firms must personalize across all customer touch points.

JULIAN: Sounds like a hoot to me. Now let's have our guests introduce themselves.

David Roe: My name is David Roe, I'm one of the partners with Authentic. My background is really in technology. I've been a programmer all my life and it's been pretty much in the digital content, digital experience space overall. Me and my partners founded Authentic about six years ago. And though we started out really with a basis in technology, we acquired an agency about four years ago and now we really look at ourselves as an interactive agency.

Adam Crow: Hello. My name is Adam Crow. I am a Technical Architect with eight years experience in the industry. I'm one of the co- founders of Blended Digital. Blended is an outcome- focused marketing technology consultancy. We work with companies looking for digital transformation to help them implement the right solution for their requirements. We recently just turned two years old and we have a range of clients across the financial services and non- for- profit inaudible

JULIAN: Thank you both for joining us today. Now David, we heard on the grapevine that financial services, they're a bit of a sweet spot for Authentic.

David Roe: Finserv is definitely a sweet spot for us. It's probably, and it varies at times, anywhere between 60 and 40% of our business overall. No one in our organization heads up a vertical practice, but I focus on it probably primarily. Some of our clients right now, they're working with our Ameriprise, we've been working on ameriprise. com for three years now and they have a number of different sites on there, Capital One, as well as Franklin Templeton is one we just kicked off with too.

JULIAN: And Adam, what about Blended?

Adam Crow: We really just engage with whoever approaches us. It's a startup, you want to take on as much business as possible to help you your growth. And ironically, we've got two ends of the spectrum in terms of ability to spend. We've got your financial services clients, we won a lot of the larger banks in Australia who, they've got some of the best toys to play with and configure to help them get some sort of engagement. And then on the other side, we've got some non- for- profits who are obviously pretty conscious about their budgets, but we do some really good work with them.

JULIAN: Getting to the heart of today's topic then, let's start by discussing some of the biggest issues and frustrations facing Finserv marketers. Adam, perhaps you can kick us off.

ADAM CROW: Some of the biggest issues we see are complex and often an engineered data structures, which are too complex or disconnected to the point where they become hard to utilize or migrate. Certainly, the only way to solve this is to try and cleanse the data and redesign the data model to effectively work with the proposed martech stack. The same thing goes for legacy systems and processes. Often, businesses are handcuffed to existing systems and feel frustrated and limited with integration options. There's not a quick and easy way to solve this, niche needs to be something that's understood and catered for with the solution design. Another point of frustration will be, many clients are putting a focus on bringing capability in- house. This is quite common when a client has historically had to utilize expensive consultants or contract resources to run their BAU digital marketing. So it's important with every engagement we try and build out a long- term enablement plan, so they can be self- sufficient with their martech stack and actually know how to use what they bought.

JULIAN: With finance as well, is it fair to say a lot of the challenges actually got so much data trying to work out where to start or try to look at it with a fresh pair of eyes?

Adam Crow: I think often, especially in financial services, because I've got such a vast amount of staff that often some of the internal verticals become disconnected. So maybe the sales team don't talk to the services team. So therefore your service communications have a different sort of messaging and tone and even branding sometimes to the marketing communications. So there's definitely a disconnect, that it needs to be a top- down focus to put consistency across the board.

JULIAN: Absolutely. David, you have a pretty unique way of looking at the challenges facing Finserv marketers, so pre towel,

David Roe: I'm not sure the Finserv world even thinks of it this way, but I find it to be the absolute most fascinating vertical out there to work with. And a lot of people didn't think that necessarily about a vertical that really contains banking and financial advice and insurance and those sorts of things. But if you think about it, it's the one vertical that has really no intellectual property in it. None, none whatsoever. And in fact, it's even forced to not have any intellectual property on it. You have to release all these various details about what you're doing, why you're doing it, there's a huge compliance factor on it. What really has differentiated for financial services over the years have been the interpersonal connections that they've been able to form with their customers, their culture, the culture of who they are, what they're doing and so on and so forth. But when, and even before we all got on Zooms, there had been a reduction in terms of the capability to connect with customers from an interpersonal perspective. When you combine that with the fact that for years now, pretty much coming out of the world of Sarbanes- Oxley, financial services from a digital perspective, their number one priority was really around compliance. And so if you, and you should see when we go in and we talked to a lot of these folks, the systems that we see, the checks that are in place, the processes that they follow, everything is really designed around a compliance model. And not that that should go away and not that that should be avoided, but that had been the number one priority. And now what we're seeing is a shift towards being able to communicate and connect directly and digitally with their customers. We still need to do the same compliance checks that we had before, but rather than that being our highest priority, we're now looking at bringing that customer service model to these individuals. And really not just communicating and stats and details and marketing type elements, but also why a certain organization's different, their philosophy towards investments and retirement and so on, or even insurance for that matter.

JULIAN: You blow my mind, David.

David Roe: There's one great, and I love this thought experiment. We just go back in history a little bit. Can we ask the question, are there any Finserv companies that are servicing their customers directly and digitally, first and foremost? And of course given the fact that there's no intellectual property with it, what happens? And we have to, we have Geico and Progressive who were spending quite a bit of money on their digital experiences, their advertising. That's the only real intellectual property that they have are those brands and how they interact with those customers. That is our end game. That is the result that we'll see is that you need to be digital, you need to be out front, you need to have a brand, you need to have one that differentiates and it needs to bring a value to your customer that replaces what you'd have if we had a product or service that was palatable, for instance.

Kayla: Some few years, what you're saying is we'll be able to just do business with the Geico gecko instead of people.

David Roe: I'm sure you would. You can right now, really. I'll tell you, my favorite one is the alligator arms commercial, where they're all eating at a table and there's alligator there. Have you seen this one? I'm sure you can find a spot for it in the video.

JULIAN: Well, I'm sure we can. So to be successful, Finserv marketers must have strong creative in order to own the message and then look to develop genuine relationships through a clear cross- channel communications strategy.

David Roe: You need to be able to attract customers, you need to be able to inform those customers, and then ultimately you need to be able to service them. And so when you start working from a digital perspective there's a service element to it, which is where I think messaging certainly comes into play from a Cheetah perspective. And that's one of the reasons we really enjoy the tools and messaging capabilities in the Cheetah Stack. If you don't have the infrastructure to do it there digitally, someone else is just going to come along and copy if it's successful. And now you've lost market share.

JULIAN: Yeah. So sticking on the communications front, David, as you're on a roll, what are some of the best practices when it comes to messaging prospects and customers?

David Roe: We have a couple of things. One, we have inbound marketing capabilities that we want to support, whether that's email or social or any of those sorts of touch points. We want to combine that with personalization so that we can identify the motive of that individual in terms of what they're trying to react to. Now, the second thing I'll throw out there is that it's really great when the financial services space, especially in the advisory world, is able to reach out and have individualized messaging to their customers. What I've seen is, from working with quite a few companies over the years, especially in the advisory world, whenever the market goes down, traffic goes up on that site. They want to see how they're performing and what they're doing so on and so forth. And if you have the capability to make a, or take an action as a financial services organization, and then have that action, no matter what it is, move automatically through into a messaging capability that reassures or informs or gets ahead of what that message is. And you can do it automatically, even with millions of customers, we're able to segment and cross check who these individuals are and get the proper messages out.

JULIAN: Adam, throwing this your way, how do you and the team at Blended approach personalization?

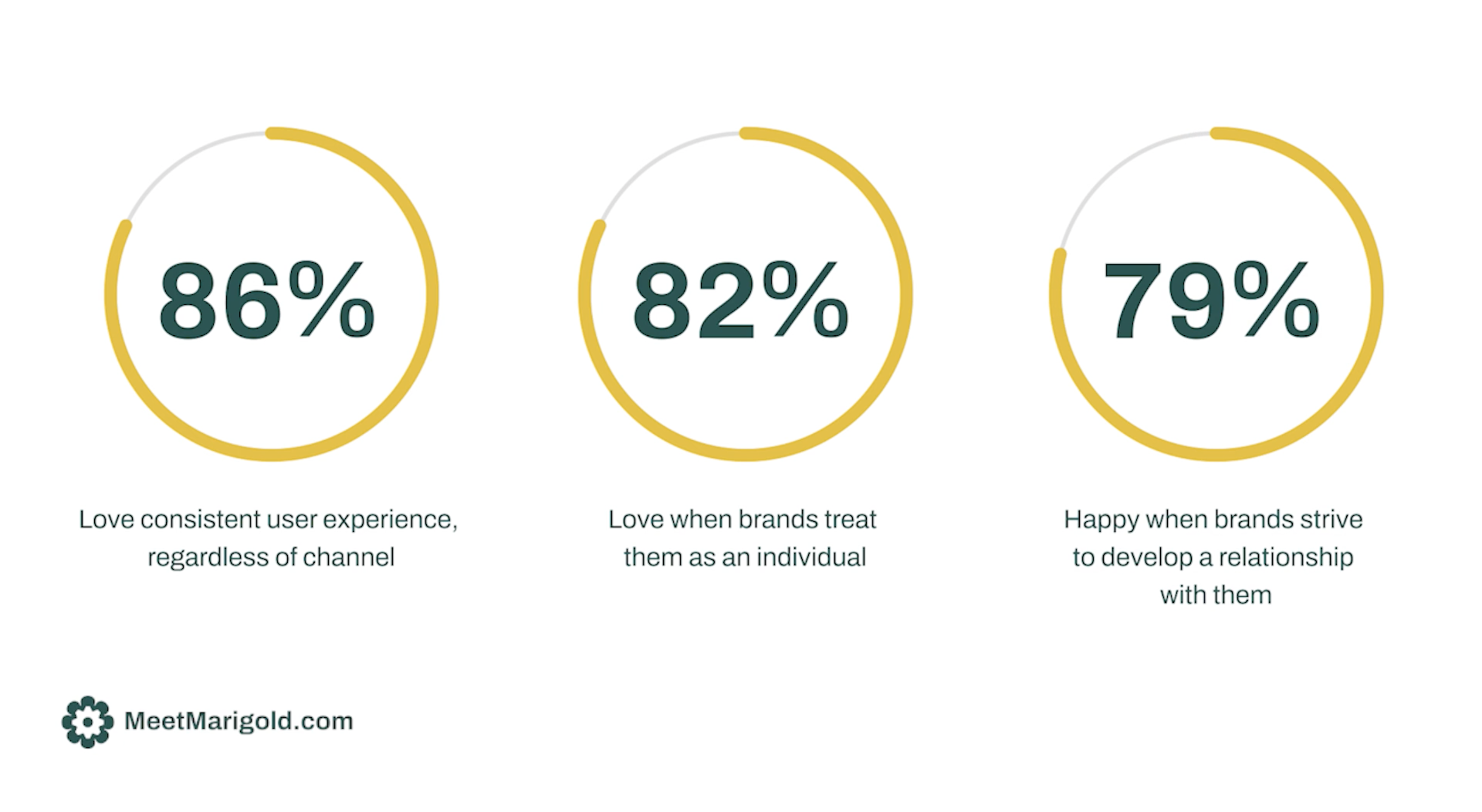

Adam Crow: I'd say it's important just generally keep personalization consistent across all digital touchpoints. So not just test and learning content in each channel, and we consider that not every customer or prospect behaves the same, they just build a fabulous email campaign, build a fabulous customer journey, map them out, consider all the referral sources and all the devices which may be utilized and keep the messaging on the same. The effective digital marketing communications, the foundations haven't changed basically in most of the recent years. And the pillars from our perspective as to how to drive these campaigns' effectiveness is historically being the who walked and how pillars. So what content am I sending? Who am I sending it to? And how am I sending it. The who representing our ability to understand your audiences, build out segments, so we're targeting based on common conversion traits and behaviors that are mostly to want to engage with your content, the what being already widely understood topic. It's what concept am I sending? Is it personalized to that person and that brand? And then the how representing the digital touchpoint used to engage that user, different people engage with different channels in different ways. Some people engage more with social than they do to, say an email campaign. The interesting one from an A and Z perspective is the sort of next pillar that we're really testing is the significant impact of the web portal. So real- time interaction management is a new point of focus for digital marketing. It highlights the importance of engaging with a prospect as soon as possible. So it's a shared interest. It's something every sales person has known for years, but now extends to digital marketing. What we're doing, where they exert at is extending this concept to test when the right time is. A lot of the time, you are most likely to see the best results when you're engaging with them as soon as possible, but what, after that. For example, if somebody fills out an online mortgage calculator, what is the best time to contact them for a conversation if not directly after, is it 6: 00 PM when they finished work? Is it 7: 00 PM when they could be having dinner? Is 8: 00 PM too late? The importance is to test your understanding of your customers and prove the one behind your strategy is correct.

JULIAN: What are the most important experiences that an insurer or bank should try to personalize?

Adam Crow: I'd say pre- sales or high volume experiences for financial services. Let's take an example of what a prospect is filled out an online request form for a call- back to discuss a specific financial product, be it a mortgage or insurance product, or something that. The worst possible experience, if you capture a ton of data online within the form and not passed out there on to the frontline call center. Some of the information is key and gives the prospect confidence that you've actually listened to what they've asked to talk about and you're calling me back with the answers. Not calling me back and ask me all the questions again, it's just a bad customer experience. It's going to sour you with the brand basically.

JULIAN: Have you worked with any clients that have put this into practice?

Adam Crow: Yeah. Honestly, the right time philosophy we spoke about before proving your own understanding. So you might think you know your customers on any of your prospects, but prove it because often you might be surprised and something like that can easily be done as well as the sort of extended version of test and learn. But it gives some sort of validation if nothing else, to your marketing strategy. So that was something that we've done recently where they inside in that we've tested what is the right time to engage them after they've done a property profile report. That's been one of the projects that we've worked on and the result of that was a 30% uplift in conversations that progress towards sales. So that's pretty significant results.

Kayla: Now with digital, how do you feel banks and financial services in general are handling that shift, and how can they do a better job of making that personal connection online versus in- person?

Adam Crow: It is a problem. I'd say they're honestly struggling. Some of the larger companies in particular, still going to keep that one- to- one conversation going and that is the most important thing. There's nothing an old fashioned tangible conversation face- to- face of how do we solve this problem? And especially with things like money and insurance and health and all that sort of stuff. And you want that guarantee, which you don't get from a chatbot or something like that. So I wouldn't say they've all solved it, but at the same time, there's been a lot of investment in financial services around speed to engagement, as we spoke around before. So it's the customer is engaged with you, or if they've got concerns around it, that's preventing them from converting or engaging further. It's about getting to that customer very quickly and having an actual conversation. So there's a heavy reliance and flooding even of call center capability at the moment. They're just getting so many leads and conversations through, whereas historically that had been routed through a bank or something like that. So it's something that is scaling up pretty quickly, but obviously that'd been blindsided by this. So it's not an easy fix.

JULIAN: David, going back to it being quite a sensitive and regulated industry, how do financial service brands approach personalization?

David Roe: So personalization, this is a pretty big topic and really across the board for me. First off, we want to look at it when our channel is, are we messaging personalized information out? Is that going out or are we talking about how someone's arriving to our brand and what we're showing them? And what I like to think about is, personalization for me really comes into two flavors. And you can mix and match them, right? There's contextual based personalization, which is, I'm 45 years old, I live in Virginia, I'm arriving on a desktop. These are all context variables. And these may be things that we can know from a signed inexperience, so attributes that maybe I've provided, they can be things that we've derived from our visit, perhaps we can look at an IP address or something along those lines and figure out where somebody lives. Any of those variables really fall into a context- based personalization approach, right? And we see that a lot. I've spoken to so many advisory organizations and they usually have three main audiences. They'll say, hey, we got individual investors, financial professionals, institutional investors. And to me, that's just a contextual based personalization for who you're servicing from a visitor perspective. And a lot of times they'll have terms and conditions that they have to accept or whatever else. And those are just variables that we can look at and say, hey, here's the context of why I want information from this organization. So that's it. B. the second one, and this is the one where I think it gets a little bit more fun is behavioral- based personalization, right? Which is where somebody is acting in a certain way and we are able to derive based on that behavior, that we want to show them something. And my favorite one to start with is from inbound marketing, whether it's social, whether it's an email campaign, whether it's a text link or any of those sorts of things. If somebody reacts to something that we put out there, we should cover that, let's just keep that going. It's really about relevance, right? Let's get the most relevant content and experience to an individual based on what they're looking for. And that's really how we try to think about it overall. We did an experiment the other day to talk about messaging. And what we're trying to do is look for a personalization strategy in the financial services world. And what we wanted to find is from a messaging standpoint, if you're trying to move folks through a sales funnel or a conversion funnel, something along those lines where we're attracting customers, we're bringing them in, and then ultimately they either sign with an advisor or they open an account or something along those lines. Can we accelerate that through personalization? And the theory is that, first off, you have default content, you have default experiences, you have smart people who work in your organization and write the differentiating content that's out there. And so a lot of times, I think marketers especially get focused on personalization because it's active, it's something they can do, right? It's an action we can take place, but it's important to figure out that that default content, that default experience still has to be the best that it possibly can. If you offer a personalized experience or set up personalized messaging, that is really the outlier, right? Barring contextual based stuff. I'm sure if somebody in Virginia or somebody in New York and you're sending out different notes or different messages to each of those, that makes a lot of sense. But if we're talking about behavioral- based personalization or what somebody is arriving on your site or is reacting to your messaging for, if we're looking at what that is, there should be something that we consider our default, like how we're going to talk about our product, how we're going to message it and so on and so forth. And then usually, a lot of times, if you can get very specific on what somebody is interested in or what their motivation is or what that behavior is, right? You can find an outlier. And so this would be a different experience, a different message, a different piece of content. And the idea there is that they'll move faster through that conversion funnel. Now, if that specialized message at that personalized message works better than the default for everybody, or more than the personalized folks, you should really consider that becoming the default, right? Because it's just a better message overall. It's not we've found a subset of our constituents who are reacting to it better, we just found a better message overall, and that's why they're reacting to it. So there's a lot of study needs to be done when we're activating personalization, because we want to both make sure it's more effective, which it has to be. And if it's less effective, then you're wasting your time. And then also, if it's so much more effective than the default, and you need to test against that as well so that you know, hey, maybe I just have a better message here.

Kayla: How do you balance the line there around being personalized and trying to drive that engagement, but also not being creepy?

David Roe: Just don't be creepy. I think it's really it. You don't invade people's privacy, but you're trying to figure out the dimensions for what they're looking for and you try to be relevant to it.

JULIAN: And these organizations have checks and balances in place?

David Roe: The privacy checks are in place. I think the technology is socialized enough that so long as you aren't doing something really creepy like looking at somebody's check- in account for what they've purchased, and then posting something on their own page about it, I think they're pretty safe overall. Really, we're just trying to figure out what that relevant experience is, meaning, what are you trying to do right now and, let's give you more of that and help you find what you're looking for.

JULIAN: Yeah. Certainly, one of the things we're big fans of, and obviously we preach with, from our Chia side is just asking people and doing it in a way that's again, compliant and it ticks all the boxes, but brands across the board, even in insurance, banking, Finserv should have confidence to ask what's going on with their customers.

David Roe: Well, people like it. Yeah, they like a relevant model and it's saving them time and it's making it faster. And personalization is a huge bucket. It basically, as a definition it's, I'm giving you something, knowing something about you, I'm going to give you more of what you want or give you something that we think you're looking for. And so why wouldn't you want that, right?

JULIAN: We would have mentioned martech stacks and some people are big martech stack, some people have small, but they're all complicated and there's always a variety of softwares floating around. How have you guys approached, over the last few years auditing ones that you identified as ones that could be good for a potential client.

Adam Crow: Yeah, absolutely. For us, it's around understanding the price points because that often leads to the eventual decision. So it's not something we'd bring up with the client, they want we, as our consultants need to know where they fit within the chain structures. They are tier one expensive product or is it something that's going to be more digestible for marketing functions that have specific budgets. And then it goes on from a capability standpoint. So you look at everything that should be mandatory in a standard monotype platform, can you do personalization? Can you do audiences? And then in the new set of technologies, can you do these sort of machine learning models and things like that? So we really need to deep dive into the platform and as techies, we love to table pieces and just figure out why and where they work and where they don't essentially. So we know that if we pass them on to a client, it's a good recommendation because we've essentially field- tested it.

JULIAN: David, do you take a similar approach at Authentic?

David Roe: Look, we are in an agency first and foremost, which means we are agents of our customers and 99 times out of a hundred, the work that we're doing, we're trying to make our customers money, right? We're trying to bring our influence, our capabilities, our offerings to the table so that they'll ultimately be successful because of us. And that almost always means more conversions, more dollars everything else. It's my personal dream to have one of our customers refer us to another customer and say, that's authentic. They'll make a hero out of you. That's our goal, right? And so when we start looking at technologies and who we want to partner with and why, it first and foremost comes into that. It's, hey, we understand a lot of these technologies maybe a little bit faster than our customers do because we're immersed in it all the time. Not that we're smarter, we're just practiced in it. And so what we do is we try to look, at how can we pull together an ecosystem? And ultimately, if I was in my customer's shoes, could I make money if I use this tool? And the answer with Cheetahs is, absolutely. And the reason we go down that road is because what we want and the reason we Cheetah is, it fits the view that we're looking for, right? Which is that interactive capability to deliver a next generation level experience. Cheetah offers an incredible array of SAS services, whether it's loyalty, whether it's messaging, whether it's the experiences piece, all of them are built on microservices, which means that we're going to be able to consume and deliver that experience in our own presentation, right? We're not going to have to go off and worry about, well, are we going to have to I- frame this or what it's going to look like? We know we're able to make the Cheetah services sort of intrinsic to the customer experience overall. Take that as number one, right? So that's the first thing that we're looking for. And then second is really the capabilities. If we look at Cheetah messaging, there is not a channel that we cannot service with Cheetah messaging. We literally can hit, if we wanted to, we could tie a fax machine up to it, if we had to, right? Just using WebEx, I'm serious. There is not a channel that we couldn't service from that capability. And I think that's why we really... Where we see Cheetah differentiating the most, is really just, you guys really have the view of what that next generation application and service capability is, and you woven all these technologies together to it. And so it's just been a great thing, a great partnership.

JULIAN: Let's end with some rapid fire cues. Kayla?

Kayla: What technology or trend are you most excited about in the next coming months?

Adam Crow: Of course, it's all about the CDPs and actually rolling up the sleeves and getting stuck into some machine learning and building out a model to drive engagement and uplift and stuff like that. It's only going to get bigger and better from here. We're starting to see the products actually hit the market place and get rolled out. Obviously we sell it all with jazz hands presentations at the start of the year and at the end of last year, but now we're actually seeing them being put into genuine use cases. So it's fun time for us.

David Roe: Single page applications, really. It's been a kind of a constant for us, that is whether you're using react or angular, the idea that we can paint a different view where we can just disrupt what the traditional UI looks like for something on your phone or whether it's on your desktop or whatever else, the fact that you can now, just by simply removing the idea of a page, refresh that you can do that is just amazing, and animations is just out of this world for us. And we continue to experiment and iterate on it and evolve.

Kayla: What marketing channel is the most underrated, do you think?

Adam Crow: I'd say WhatsApp is a great upcoming channel, which can gain more traction in the future. I recently had a great customer experience with Booper where they engaged me by WhatsApp, which was quite a surprise to me. I'd never experienced it before. They answered all my questions and eventually it led me towards an acquainted policy.

David Roe: SMS, that ability to send images and rich content to somebody's mobile device. I just don't think it's being used at all right now in terms of what it could be. Combine that with something like a mobile app or another device, it just costs more than an email and I think that's really where people are going with it, is they've been reluctant to do it because they're like, well, I'll just send it by email. And also I think it is a factor with where it arrives and how it lands. There are some questions there, but from a marketing perspective, I think that is probably one of the hottest. And part of the reason is the timeliness of it. If we think of email, we think of it as it's almost slow, if we're texting, we're having a conversation and if you can do something cool overtaxed, I think that that is a great way to attract a customer or get your message out there.

JULIAN: And on that note, we shall call it a day chaps. We're hugely grateful for your time and insight. Thank you, David Roe and Authentic. Thank you, Adam Crow and Blended Digital for sharing some of your uncaged wisdom. And all of you out there listening in, thank you for tuning in, but we're not quite done yet. Please do stay for an extra 10 minutes to join Kayla, myself and our resident Finserv expert, Kyle Murphy, Client Success Director at Cheetah Digital, for the discussion after the discussion. Yes. We've taken a leaf out of the Bachelor's book and created our own After the final rose type chat. Kyle, welcome to after the gold rush, see what I'm trying to do there? We'll move on. Kyle, did you enjoy that?

Kyle Murphy: I think it was a great session. I'm glad to be part of the recap.

JULIAN: More glad to have you here. I think our panelists both shared some very interesting thoughts on how they approach from their perspective, the industry that we were talking about. Was there anything, particularly from the panel that you heard that caught your ear and we can be a bit more Cheetah- orientated at this point? Because we're Cheetahs.

Kyle Murphy: Yes. So I thought the conversation was excellent. Certainly hit on a number of different points from a personalization perspective, being able to use contextual data and behavioral data to actionably communicate with customers is important. One of the campaigns that I've seen works pretty well with one of my financial services clients leverage contextual data. There was really a campaign that was dedicated to notifying customers that there's an event that's going to happen, it's a live in- person event and this is actually during the coronavirus quarantine period. So what was important in terms of using contextual data was leveraging real time information that says, hey, you can buy tickets now to this event, or you can learn more about this artist and when they're potentially going to be available. So being able to communicate with customers and to personalize their experience based on real- time data was really important, and I think that was one of the things that I was able to pull out from that conversation.

JULIAN: How've some of the brands you worked with, financial service brands had to cope with the communication during this time?

Kyle Murphy: So financial services companies are unique in that, in many respects, big banks have to deal with the government, in terms of communicating with small businesses and business owners, right? So when the PPP program was announced, it was widely reported that there were a number of delays in communicating how the program would work. And essentially that impacted big financial services companies, banks that had to communicate with business owners that really relied on that and those loans to keep their businesses afloat. And so coming downstream and in the way it impacts to get to digital, it essentially kept us on all hands on deck, right? So we partnered with our clients to make sure that as soon as they received accurate information, that we were able to set up and launch campaigns at a moment's notice. But very frequently, either the communication itself changed or the direction of the campaign change. And so those are some of the challenges that came out of coronavirus period but being nimble and being able to adjust is something that just comes with the territory.

JULIAN: Is there anything else that tinged the ears? I think that's a term, I'm going to use it. Tinging ears.

Kyle Murphy: Yeah. One of the things that I think was discussed was around how compliance was number one part priority from a digital perspective many years ago. I think it's still a top priority for financial service marketers that are watching this right now. They are very keenly aware of that, that the world revolves around compliance, right? So much so that it can easily get overlooked when evaluating the requirements of scaling a large complex dynamic marketing program. And for example, one of my main clients, so top five U. S. bank and over the last few years, they've been increasingly pushed to make sure that their emails are compliant from an ADA perspective. Which essentially means that the content that they send will have to be fully accessible for people that have disabilities. Now, adherence to this compliance requirement is great from a universal accessibility perspective, right? But introduces a whole new set of challenges from a design and coding perspective, right? And so financial service marketers have to be nimble enough to play in this space where we can still achieve engagement goals and results while still adhering to this ever- changing dynamic of compliance.

Kayla: With the compliance piece, how does that affect our ability to, like you were talking about, be a lot more agile or nimble when it comes to the client's needs?

Kyle Murphy: It requires a Cheetah to stay on top of all of the emerging legislations that are happening around the world really, right? So we have an internal privacy department that's focused on GDPR at a more global level, but even as something as comprehensive and local as the CCPA, so the California Consumer Privacy Act. But that is something that marketers need a lot of handholding to walk through and to understand. And so that's something that a service that we provide, but something as universal as ADA compliance as well. These are things that our coding team will have to study, prepare for, and know how to actually implement at a campaign level and on a client level based on the requirements of their campaigns.

JULIAN: Why are we good with financial services and other highly regulated industries? What are some of the things that set us apart, why people do put faith in Cheetah Digital?

Kyle Murphy: The first thing I would say is, the people, because first and foremost, we have to have the right folks that are not just order- takers, but our listeners that can push back and challenge something that either doesn't align with a client- stated requirement, or it doesn't align with the processes that we've developed together. And so we very much partner with our clients to understand what their needs are, but also develop specific processes that are documented and can be traceable and share back with the client to ultimately give them the confidence that we're performing the right amount of checks and balances before campaign is even deployed and everything up and through, to follow through in terms of making sure that if there's a one- to- one reconciliation that needs to occur, it can easily occur, for example, that we're doing that as well. So there are a number of different things that our resources have been able to accomplish, just partnering with our clients. And then the feedback that we get in turn is that, they can't see themselves without our resources, because day in and day out, we're thinking about their business constantly, making sure that they're prime for success. The other components are things that's usually top of mind for marketers, but by and large, they're really important for transacting, making sure that the business transactions that we facilitate are accurate. And so that comes in the category of compliance and security. And so when I think of compliance and security, I think of some of the certifications that we may have, or may not have heard of about, but it really critical to our partnerships. So being able to say that we have a high trust certification, we are SOC 2 compliant, right? There are certain things that are looked upon from a business perspective, from a security perspective. The information security officers that are heads of organizations at financial companies, they look toward our company to have in place things that we can confidently stand on to say that, yes, if you're using your data with Cheetah Digital, it is secure. We can confidently secure your information, whether it's hashing, email addresses, credit card information, or not even passing that information over at all, and completely tokenizing that information, so that it's completely secure. There are a number of things that we have that are at our disposal to make sure that financial services communications are sent out securely.

JULIAN: It does seem, from what I learn as I'm going that certainly this is an industry where there is quite a services- heavy side to things that we provide. What is it about the campaign creation from our side?

Kyle Murphy: It's a good question. I think some clients are very, very comfortable with having their existing employees set up campaigns, we'll purchase a piece of software, login, set up a campaign, completely QA at themselves and deploy it on their own. For financial services marketers, a lot of times, it's even better to partner with someone that specializes in digital, especially in email communications. And that can understand all of the nuances that we discussed earlier, whether it's ADA compliance, whether it's making sure that our processes are adhered to, making sure that the campaign and all of its, let's say dynamic contextual components and all of the number of versions that have to be reviewed and approved are set up properly the first time. That can save a lot of headache along the way. And so we, at Cheetah Digital, one of our strengths is providing that white glove type of service to our clients to make sure that when you hand over a campaign to us, the way you get it back is the way it should be, and then ultimately performing those checks and balances that go on behind the scenes.

JULIAN: Brilliant stuff Kyle, thank you. And with that, we'll bring the curtain down on today's animated episode of Signals 20 For all of you still with us, we hope you've taken a few things from this discussion on marketing and financial services. Please join us next time, where we're talking sports and media. We have guests from some big premier league clubs, the merit of corporation, and more to learn. That's all folks.

Kayla: Signals 20, the content series for marketing rockstars.

DESCRIPTION

The Financial Services Industry (FSI) has always required careful navigation by the highly skilled marketers who work in it. With FinServ customers only becoming more digitally savvy and expectant of personalized communications, experiences, and offerings relevant to them, marketers here are having to make new decisions regarding the right path to take.

We gathered a panel FinServ experts to discuss the unique challenge they face when it comes to digital marketing. In this recording you’ll learn:

- Which touchpoints are essential for connecting with consumers

- How omnichannel marketing is crucial for each stage of the customer lifecycle

- Why personalization is the key to anticipating and responding to customer needs

When 57% of financial brands are putting their resources into communication tech, and 48% completely changing up their go-to-market business models, it’s more important than ever to have the right digital strategy.

Today's Guests

David Roe