ESPs and CDPs Collided - Now What?

- 0.5

- 1

- 1.25

- 1.5

- 1.75

- 2

Brian Finfrock: Hi, my name's Brian Finfrock. I am a Director of Product Marketing at CM Group, and I am pleased to be joined today by Chris Marriott of Email Connect. We're going to have a great discussion about the collision and technologies between email service providers and customer data platforms and what that means for marketers, and how you can plan and adjust for the future based on the changing landscape that we're dealing with.

Speaker 3: Let's dig into it.

Chris Marriott: Thanks Brian, and it's great to be here. Thanks everybody. If we want to talk about and understand the vendor landscape of 2022, it's good to start back in 2020. Back in 2020, CDPs were suddenly the talk of the town. They'd been around for a while, but suddenly, everybody was talking about CDPs. And as I looked into CDPs, my business is managing RFPs for enterprise brands looking for a new ESP. And as I heard more and more about these CDPs and their capabilities, it began to sound like a lot of what they did or were offering were things that were already found in ESPs. So, working with a friend of mine, we sat down and we looked at the list of what CDPs could do, the list of what ESP could do, and lo and behold, in this Venn diagram, as you can see, there was tremendous overlap already in 2020 between these platforms. And I predicted at the time that this was only going to get worse, that they were on a collision course to one another. And once that collision happened, there were going to be fundamental changes to the MarTech landscape and fundamental changes to how folks, who were in the markets for CDPs and ESPs, had to approach that selection process. Little did we know, in 2020, that the fun was only starting. I never thought that the collision would happen as quickly as it did, but here we find ourselves in 2022, at a time where the collision has occurred. And we're going to look at today what that means, not just for the ESP landscape, but how it's impacting the CDP landscape. One of the early results of this in this post collision environment, is that, as I thought would happen, the MarTech landscape has become much more confusing for the people making buying decisions. The bottom box here that we've marked out with a box, the marketing technology landscape is very confusing and is hard to know how different products fit together. That is a direct result, in many ways, of what we've seen in this collision of CDPs and ESPs. So already, one of the first fallouts is the buyers of these platforms, and of MarTech platforms, in general, are confused which do they need, what do they need, which do they buy first? So, we're going to take a look at that and hopefully answer some of those questions today.

Brian Finfrock: Yeah. And I think it's fair to say that it's not just the buyers that are impacted by this. There's a lot of technology companies that have ESP and CDPs and there's an overlap between those technologies, and they're trying to figure out too which product features are more important to which group, and which elements do we really need to shore up the parity between what we're offering, and how do we make this so that it's accessible to the people who need these tools and they have all the things that they need to do what they want to do.

Chris Marriott: That's exactly right, Brian. And we're going to see how different ESPs have reacted to this collision, and in fact, how different CDPs. Because the CDP landscape is reorganizing itself in many ways at the same time that the ESP landscape is not necessarily deliberately reorganizing itself. But as I look at the landscape, I'm seeing dramatic shifts in how I think and organize the various platforms. Again, before we get into where we are in 2022, let's take a step back and define what the letters ESP mean in 2022. Interesting fact is, most vendors that have email platforms don't even call them ESPs anymore. But on the other hand, I work with brands, and brands do call them ESP still. So, fun fact there for vendors. The idea here is that brand's definition of what the letters ESP stand for have grown dramatically as these platforms' capabilities have grown dramatically. So, in 2022, when a brand talks about ESP, they assume that ESP is going to come with all of the following capabilities. Number one, the traditional promotional broadcasts and email marketing. But number two, they expect marketing automation built into the platform, triggers, journeys, automations. They don't expect that they need a different trigger platform, they don't expect that they need an automation platform or an orchestration platform, they want and expect that all in the same platform. And lastly, multichannel orchestration. They expect an ESP, and I know the E stands for email, to also include SMS, MMS, push to app, mobile, push, social connections, and even push to browser these days. So, again, the term ESP has broadened dramatically, and I think that's correct.

Brian Finfrock: And those needs for marketers vary from use case to use case. Everyone's using the email capabilities within their ESP, but absorbing those or taking advantage of those other technologies that the ESP offers... some are using SMS, some are using push, some are doing all of their mobile through theirs ESP, but more often than not, that technology is still broken out into silos.

Speaker 3: True. And it's also important to remember that the workhorse of these platforms remains email first and foremost. I can't tell you that how many brands have said to me, " Yeah, we're doing an RFP and we're looking at multichannel capabilities," and this and that, but remember, email is still 90% of what we do and 90% of the revenue we generate. So yeah, this other stuff is good, but don't forget the email.

Chris Marriott: So, this is how in 2021 I looked at the vendor landscape, and this is not one of those diagrams where your placement in the diagram could, can be better or worse. There is no better and worse placement in here. This is what I use with brands when looking at how to differentiate the offers out there and so that they can make a smart decision on who to include in an RFP. So, if you look at the horizontal, it starts with tech only on the left, and again, down there you see platforms, what I call MTAs in the cloud, that are just very, very tech focused platforms. As you move over to the right, you get into more services offerings coming with the platforms, until you get all the way over to the right and you'll see email agencies there that don't have platforms. When you go on the vertical access at the bottom, you start with simple messaging platforms, and again, that's where you find those MTAs in the cloud. As you go towards the top of it, you have additional offerings within the platforms, some of the things we talked about, multi- channel, the ability to have other data sources, and those types of things. And this is still valid if you're talking about looking at the vendor landscape. But as we'll see shortly, there's another way to look to vendor landscape post collision. So, rethinking the vendor landscape, and I will lay this out in a diagram, but let's first look at what I see as three tiers of ESPs these days. And from the diagram we just looked at, any of those ESPs could be falling into one of these tiers, depending on their capabilities. And also, it's important to note, as we go to left to right in this, it's additive. So, what you find in an ESP, you find in an ESP plus, plus the additional things in an ESP plus, and then what I call the full data ESP. So the ESP is just a messaging platform. That is the basic ESP platform, but it is, again, multichannel and all those things we said as the modern ESP. When you go to ESP plus, you begin to add some of the things that you find and that CDPs talk about. You talk about data assembly and more advanced analytics, aggregating data from source systems, machine learning, predictive modeling, real- time interactions and product content recommendations. And the key there is that real- time. And then if you go completely to the right, it's there is what I call the full data ESP. And this is where there's first party data and loyalty program capabilities built into the platform. And as we all know, first- party data is becoming increasingly important, and certain platforms have noted that and have done things to create opportunities to provide their clients with more zero and first- party data, and frankly, Cheetah is one of those. Cheetah Digital is one of those with its loyalty connections. This is where, again, there's first and zero- party data generated in the platform. There's ability to measure intent in the platform, create, launch, manage, track loyalty programs quickly and personalizing rewards, et cetera. So, these are how I begin to see the tiers. And it's developing. And as you'll see, at this point in time, the vast majority of those ESPs on that previous chart fall into the ESP category. There are a couple in ESP plus and there are a couple in full data ESP, but I think this will become more and more the norm of how ESPs align themselves in the marketplace and in the landscape.

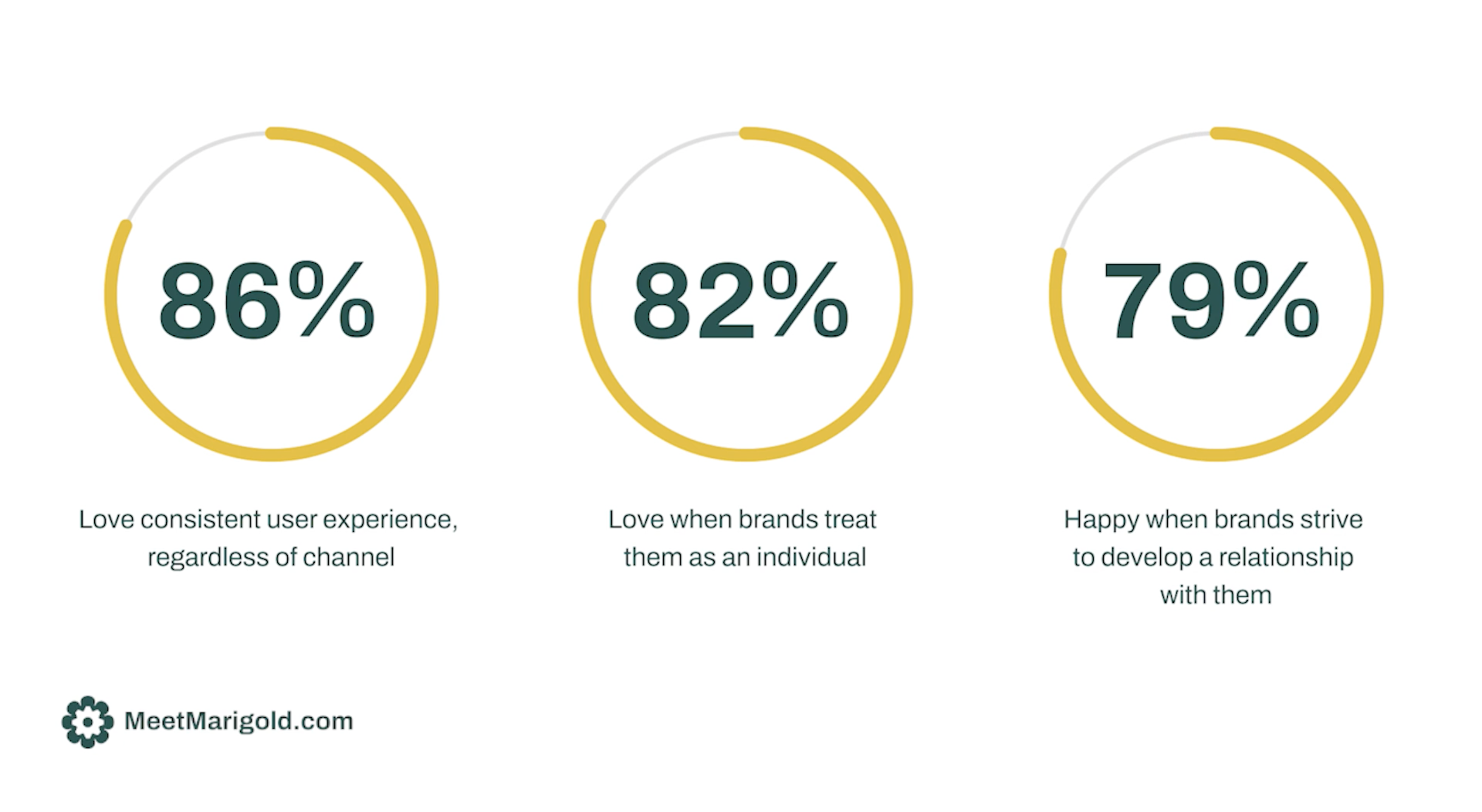

Brian Finfrock: Yeah. And I think with data deprecation, the impact that it has on marketers and their ability to actually leverage their email specific data makes it more and more important for them to have that reliable first- party data and zero- party data that they can get directly from their customers by asking for that information and sharing value in the interaction. It's a totally different approach, but when anywhere between 30 and 75% of your audience, depending on how many of them are on Apple devices, are now hidden from you, but look like they're always engaged, that's a scary time. And having reliable data is so critical to being able to achieve goals that we have as marketers.

Chris Marriott: Exactly. And getting that reliable data to the launch point is absolutely critical, because if there's a disconnect between, I got a bunch of reliable data here but it's not activate, I can't activate it particularly at the time of email assembly and launch, that disconnect is going to create problems. So, you're absolutely right, Brian, it's not just the ability to make that available to customers within your platform, but to activate it in real- time is critical. And that real- time phrase is something that CDPs have been talking about forever, " We're real- time, we activate it real- time." But you're hearing more and more of that from ESPs, recognizing the importance of that data latency will kill an email program success. A little over a year ago, I wrote a column where I said, " If you begin your vendor..." Because back at the beginning, I mentioned that part of the confusion today is where do we start if we're looking for MarTech platforms? Do we start with an ESP? Do we start with a CDP? How do we know where we need to start? Well, Chris Marriott back in 2021 said, " If you begin your vendor selection process with the search for a CDP, you're always going to need to add an ESP as well." Well, as you're about to see, this didn't age too well. The idea today is, in this post collision world... and in fairness to me, I hadn't realized we were post collision world yet in 2021. I recognize that now. So, the question here is, do you still need both types of platforms to get everything you need? And it's the list of sort things that if we'd squashed them both together, you would find. So, now, before we can answer that question, let's take a step back and let's look at how the CDP industry or landscape is beginning to align itself. And full credit to the CDP Institute and David Raab, these are his categories. I know Gartner has their categories, Forrester has their categories, but based on the studying I've done of the market space and the landscape, I think David Raab has the best take on what CDPs look like and what should expect. And again, each category is additive as you move from left to right. So, on the left side we have data CDPs, which is the original CDP. These were just data assembly platforms gathering customer data, minimum set of functions required to meet CDP Institute's definition. One step up, and now we begin to hear some terms that we hear ESPs use, data assembly and analytics. Oh, remember back that ESP plus, analytics including customer segmentation, automate data distribution to other systems. As we move further right, campaign CDP, this is data assembly, analytics and customer treatments. Now the overlap with ESP is becoming way, way more pronounced. You have orchestration customer treatments, you have treatments for different campaign individuals, so you have personalized messaging added to it. And then on the far right, we have what David calls the delivery CDP, data assembly, analytics, customer treatments, and, here's the kicker, message delivery. These are, literally, platforms that call themselves CDPs that use the same MTAs in the cloud, platforms like Cordial and Iterable use to deliver their email out of their system. They can deliver mobile, CRM advertising, or often other different channels. They often started as merely delivery systems, but added CDP functions to support advanced analytics, personalization, or multichannel campaigns. If you look on top of both of those, what I've seen, and this I think will further drive the changes in the CDP landscape, is that the bottom two are the platforms mainly referred to by IT or preferred by IT and data teams. When they're out looking for a CDP, those are the types of platforms they focus on. The other hand, the top two platforms, the ones that sound and talk a lot like ESPs, are preferred by marketing teams. And I've actually talked to various CDPs, and depending on which one of these buckets they fall in, they'll say, " Well, if it's IT, we know we're not going to be picked. We know we're not right for them." And so, they're already beginning to understand that there are differences in CDP selection based on who's doing the selecting. I'll say another interesting thing here that I've seen is that every single RFP post COVID that we've run, there is somebody at that organization doing a CDP, RFP literally at the exact same time that that organization is doing an ESP, RFP. Now, we already said that what I wrote in 2021 is outdated, but I will add here that if these RFPs and these platform selection processes are not informing one another but are completely discreet, that's a recipe for over platforming. So, IT and data people, they love to go off and get their own platform, and that's fine, but it shouldn't be done in a vacuum with what the ESP or the marketing team's doing in their ESP search, bring these searches together in one form or another.

Brian Finfrock: I really love the differentiation of this view. Having spent the better part of 10 years building campaigns for really large brands, time and time again, the biggest hurdle to starting the next initiative is getting the data team to figure out how to package the data and get it into the ESP on a regular basis so that message can be triggered and do to things it's supposed to do and fit into the priority of other things. And if your biggest hurdle is getting the data there and it takes you three, six, eight weeks just to get the data resolved when the campaign cycle in total should be less than that, it's a big problem. So, it's really interesting to see that... and there really is a big difference between the technologies that an IT team is looking to manage customer data within, and a marketing team who's really thinking about the customer and that end customer use case, which is why they want more control, they don't want to have to reach out and say, " IT, give us another API." That's brutal.

Chris Marriott: Brian, that's spot on. Why you see this differentiation here is because a lot of it's about control. Let's face it, IT and data want to control the data, they want to control the analytics, and that's often to the detriment, you're exactly right, of the marketing team that wants that data, when they want it, and they want to apply it to campaigns ASAP. So, that's where the tension is going to come in these vendor selection processes, and that's why IT teams shy away from the delivery CDP because of that overlapping capabilities. Now, it enables the marketing team to have much more control over the fate of their data and how quickly they can put it to use. This begs the question, are ESPs the next evolution for many CDPs? And in other words, are those CDPs to the right of the four that we just looked at going to become CDPs? Are certain ESPs is going to become CDPs? And in fact, there's ESPs that I call ESPs and that call themselves EDPs, that the CDP Institute calls CDPs. Again, part of the confusion in the landscape, and in some ways, we're both right. So, is the future what I call ESCDP? And I know nobody wants a new acronym and that probably won't stick, but is that the future where this overlap is acknowledged, and where the industry shifts, and you have pure- play CDPs, you have pure- play ESPs, but in the middle you have these hybrid ESP and CDPs. And we're already seeing that today. Here's another way to look at the landscape you looked at earlier with all the same ESP in it. And in this landscape we have greater CDP capabilities as you move up the vertical and you have greater ESP capabilities as you move over the horizontal. And what you see there is, in the middle, you begin to see some ESPs, and what you don't recognize ESPs but are CDPs begin to come on the map, like Simon and Blueshift have some ESP capabilities, though they're CDPs, and that was their core. And you have Cordial also in the middle as a brand that has that... And that's the one that CDP Institute says is CDP and I say is an ESP. But again, you begin to see how they map out depending on how much of a CDP type capabilities these ESPs have made available in their platform, whether it's actually building from the ground up CDP- esque type capabilities, or whether it's Cheetah who's built what I call a CDP inside that sits adjacent to their ESP, providing all of the capabilities of a CDP in one platform package.

Brian Finfrock: Yeah. And I think what's most important about this is there's still a real strong perspective that it's the CDP side of things that really has the capability to do that intelligent processing, to make intelligent recommendations, to do really positive things and impact customer relationships. But you're seeing more and more brands, like Selligent and Sailthru, infusing really useful marketing practical AI into what they're doing, gives those marketers access to really critical use cases they need without having to go all the way to the platform, and then vice versa. You got plenty of customers who are really interested in getting rid of relational tables, that the time consumption of just running counts on a potential campaign to get all the data organized across multiple tables is just restrictive on production. So, having access to those really live actionable profiles that are persistent, in some ways, it just makes marketing easier.

Chris Marriott: Right. All excellent points. And if anyone out there is wondering where those CDPs that fell into the lowest two categories would appear on this chart, they'd be right down there in the bottom left corner, to give you an idea of what the lower end of that. But we're talking here about ESPs, and again, Simon and Blueshift would qualify as deployment CDPs. Again, they both deploy. Again, these are the things that, do you need both? Do you need one? Which do you start with? I'm not going to say something that's going to age out in a year yet on that. But what I am going to say is, you need to study your options, and let's look at that. But before we get there, is the CDP, as I said, are they going to combine? Are they going to go away? Is there going to be a CDP mass extinction? Gartner Group tends to think so that by 2023... and funny, that's next year. So, I don't think this one is going to age that well, but I wanted to give a different perspective than my own in terms of what someone else is thinking. And through mergers and acquisitions of their own to enter adjacent categories, there is though the hint that they also possibly see that the ESP and CDP landscape post collision is going to involve these hybrids, whether we call them deployment CDPs, whether we would call them ESP plus, or whether we call them Chris Marriott's own ESCDP.

Brian Finfrock: I think it's worth noting though that Gardner, in similar research that they released at the same time, is emphasizing that the brands who are investing in CDPs are over investing in CDPs because they had the IT team and the marketing team both looking at things at the same time, and now they're sitting on two or sometimes three different CDPs that aren't fully deployed and sharing capabilities between them. If that's the world Gartner's looking at, then I can understand why they think 70% of the vendor landscape is going to get acquired and smushed together. But I think there's another reality to that to say that the advanced CDP and deliverability technology is really a strong direction for marketers and I don't think we see that going away.

Chris Marriott: No. I agree. I agree. I don't believe CDPs will disappear, but as I've indicated and I've talked about, there're going to be massive changes in landscape. They're no longer the only best sources of data. ESPs are catching up in a dramatic fashion. Marketers, I'm also seeing, are increasingly interested in having fewer, not more, vendors. If a vendor can do more of these things well, they don't want to be stitching these things together in their infrastructure, they'd much rather have it all collectively in one place. Data and IT will always want platforms they manage, as I said earlier, that control. So, those less sophisticated CDP platforms... and sophisticated may be an unfair word, that do fewer things will continue to have a role even if we don't change what we call them. So, maybe they'll be what we call CDPs in the future. So, in closing, if you're a brand and most of you are, what do you do in the meantime? Again, it's still very confusing. First, do your homework or hire consultant who's already done his or hers. What you've just seen here though today, what Cheetah's provided you as signals is a good starting point. You need to create, and this isn't fun, a detailed requirements document for your data management and digital messaging needs. This is a crucial step, because as Brian said, you don't want to buy more technology than you need in overlapping platforms. Then determine where you want those requirements addressed. Do you want them addressed in a CDP managed by your IT and data teams, or in an ESP managed by marketing? The worst thing, as I said earlier, you can do is conduct simultaneous RFPs for both platforms. Finally, conduct a gap analysis between the capabilities of your current ESP and your requirements document. If there are significant gaps, then you have to decide, are those better addressed by a new and better ESP? Are they addressed by an ESCDP? Or by the addition of a CDP to your stack? Depending on the answer to the question number four, your next step is likely to be some kind of RFP, and this is where the person you brought in for number one will come in extremely handy.

Brian Finfrock: I think point number three there is a really, really big one, especially for the marketing teams because there's lots of research in the marketplace now that indicates that companies who allow IT to make most of the data decisions, aren't putting the customer first in their AI decisions, and that leads to AI that isn't focused on helping customers achieve their goals. Where if the shared responsibility for customer data goes across the organization, and marketing is involved in those decisions, the marketing team is going to have a much stronger push to make sure that customers are treated as individuals and treated to AI decisioning that's actually helpful to them instead of being viewed from a very technical Boolean perspective.

Chris Marriott: Definitely. So, I want to thank Cheetah Digital for the opportunity to speak this year, I want to thank Brian for joining me today, and I'd like to thank you all for watching. I appreciate you taking the time. And if you want to connect with me at any point, you can go to our website, www. email- connect. com, or reach out to me on LinkedIn. Again, thanks and have a great day.

Brian Finfrock: Fantastic. Thanks so much, Chris. We really appreciate you being here with us today. We hope all of our viewers are getting lots of valuable knowledge out of what we're sharing. And if you do have questions specific to ESPs or CDPs, we here at CM Group are also ready to help you navigate that space and get the questions that you need answered answered.

DESCRIPTION

As the marketing technology landscape becomes more crowded than ever, some confusion has arisen between the acronyms that make up this field. We’re going to dispel some of the mystery around two of those acronyms – Email Service Providers (ESPs) and Customer Data Platforms (CDPs).

These two platforms, while originally meant to provide email service and a place to store customer information (respectively), are on a collision course.

Join Chris Marriott, President and Founder of Email Connect LLC and Cheetah Digital’s Bryan Finfrock as they discuss the key overlaps between ESPs and CDPs, how we should rethink the ESP landscape and whether or not you need both platforms.

Takeaways:

- What are the differences between an ESP and a CDP?

- How is the market landscape changing for Email Marketers?

- How can a marketing team assess their needs and choose an ESP or CDP?

Today's Guests

Bryan Finfrock